Travel Insurance Guide

Article courtesy BH of CreditCards.com

In some cases, the insurance benefits provided by your credit card may be enough. In other cases, you might want to boost your benefits by purchasing travel insurance.

The difference may depend on where you’re headed and how much the trip costs.

If you spend $200 on an airline ticket to visit your parents, you might not need additional travel insurance. But if you’re going on a cruise that costs thousands of dollars and need to make payments months in advance, you might want the extra protection that travel insurance offers.

“It’s really up to the individual and what type of risk tolerance they have for losing money,” Mueller says.

About 25 to 30 percent of leisure travelers in the United States purchase travel insurance, she says, and the number of people purchasing the insurance has increased “as people see how hurricanes and weather impact destinations.”

Read more on CreditCards.com

How much does travel insurance cost?

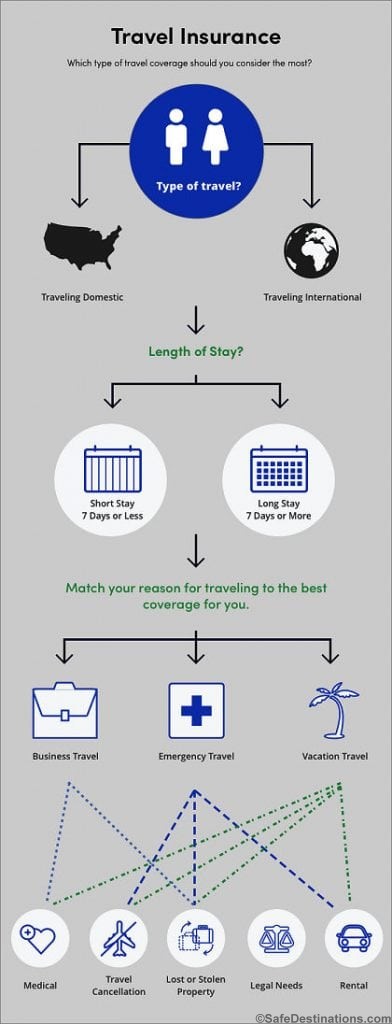

How to decide what kind of travel insurance you need? How you answer the following questions will help determine what kind of (and how much) travel insurance you should have before you hit the road or head to the airport include:

– Will you be traveling domestically or internationally?

– How long will you be traveling (short stay of seven days or less or long stay of seven days or more)?

– What kind of travel you’re planning: business trip, vacation or emergency trip (such as to get to the bedside of an ailing loved one)?

For example, if you are just going on a quick business trip, you likely will not need the same travel insurance coverage as when you are heading out on a weeklong (or longer) vacation in an exotic location outside the U.S.

A travel insurance policy usually costs about 5 to 7 percent of the cost of the trip, Mueller says.

Price is determined by the cost of the trip, the length of the trip and the traveler’s age, says Steven Benna, spokesman for the travel insurance site Squaremouth.com.

If your trip costs $12,000, and your credit card provides $10,000 in trip interruption and trip cancellation insurance, you can save money by buying just $2,000 more in coverage from a travel insurer, he says.

See related: 11 travel credit card insurance benefits

Article courtesy BH of CreditCards.com